The Basic Principles Of G. Halsey Wickser, Loan Agent

Table of ContentsG. Halsey Wickser, Loan Agent Can Be Fun For EveryoneUnknown Facts About G. Halsey Wickser, Loan AgentThe Basic Principles Of G. Halsey Wickser, Loan Agent The Best Strategy To Use For G. Halsey Wickser, Loan AgentSome Known Facts About G. Halsey Wickser, Loan Agent.

The Support from a home mortgage broker does not finish once your mortgage is safeguarded. They supply continuous support, helping you with any kind of questions or concerns that develop during the life of your car loan - mortgage lenders in california. This follow-up assistance makes sure that you remain completely satisfied with your mortgage and can make educated decisions if your financial situation modificationsSince they collaborate with multiple loan providers, brokers can locate a lending item that matches your unique monetary scenario, also if you have been rejected by a bank. This versatility can be the trick to unlocking your imagine homeownership. Selecting to work with a mortgage expert can change your home-buying journey, making it smoother, much faster, and extra financially useful.

Locating the appropriate home for yourself and figuring out your budget plan can be very demanding, time, and money-consuming - california loan officer. It asks a whole lot from you, diminishing your power as this job can be a job. (https://creativemarket.com/users/halseyloanagt) An individual that acts as an intermediary in between a borrower an individual looking for a home loan or mortgage and a lending institution generally a financial institution or lending institution

How G. Halsey Wickser, Loan Agent can Save You Time, Stress, and Money.

Their high degree of experience to the table, which can be critical in assisting you make informed decisions and ultimately accomplish successful home funding. With rate of interest changing and the ever-evolving market, having actually someone completely tuned in to its ongoings would certainly make your mortgage-seeking process a lot easier, easing you from navigating the battles of filling out documentation and executing stacks of research.

This allows them offer skilled advice on the best time to protect a home mortgage. Due to their experience, they also have developed connections with a large network of lenders, varying from major banks to specific home loan suppliers.

With their industry knowledge and capability to bargain efficiently, home loan brokers play a crucial role in protecting the ideal mortgage deals for their clients. By preserving connections with a varied network of loan providers, home mortgage brokers gain access to several home loan choices. Their increased experience, described above, can supply vital details.

The Single Strategy To Use For G. Halsey Wickser, Loan Agent

They possess the skills and strategies to convince loan providers to offer better terms. This might consist of reduced interest prices, minimized closing expenses, and even extra versatile payment schedules (california loan officer). A well-prepared mortgage broker can offer your application and financial account in a manner that interest lending institutions, raising your opportunities of an effective settlement

This advantage is usually a pleasant surprise for several homebuyers, as it allows them to take advantage of the expertise and sources of a home mortgage broker without fretting about sustaining additional costs. When a consumer protects a mortgage through a broker, the lending institution compensates the broker with a compensation. This payment is a percentage of the financing amount and is commonly based upon factors such as the rates of interest and the kind of car loan.

Mortgage brokers master comprehending these distinctions and collaborating with loan providers to discover a mortgage that matches each consumer's certain requirements. This customized approach can make all the distinction in your home-buying journey. By functioning very closely with you, your home loan broker can guarantee that your car loan conditions straighten with your monetary objectives and abilities.

Little Known Questions About G. Halsey Wickser, Loan Agent.

Customized mortgage services are the secret to an effective and sustainable homeownership experience, and home loan brokers are the specialists who can make it occur. Hiring a home loan broker to function alongside you may cause rapid funding authorizations. By using their experience in this field, brokers can assist you stay clear of potential mistakes that commonly create delays in funding authorization, bring about a quicker and much more effective course to securing your home financing.

When it pertains to acquiring a home, browsing the globe of mortgages can be overwhelming. With many alternatives readily available, it can be challenging to find the best finance for your demands. This is where a can be a valuable resource. Mortgage brokers serve as intermediaries between you and potential loan providers, aiding you find the very best home loan offer tailored to your details circumstance.

Brokers are well-versed in the complexities of the mortgage sector and can use useful insights that can help you make educated choices. Rather than being limited to the home mortgage items provided by a single lending institution, home mortgage brokers have access to a wide network of lending institutions. This suggests they can look around on your part to discover the best car loan options readily available, potentially saving you money and time.

This access to multiple lending institutions provides you an affordable benefit when it comes to safeguarding a positive mortgage. Searching for the right mortgage can be a time-consuming procedure. By dealing with a home mortgage broker, you can save time and initiative by letting them take care of the research study and paperwork associated with finding and protecting a finance.

Fascination About G. Halsey Wickser, Loan Agent

Unlike a small business loan officer that may be handling numerous clients, a home loan broker can give you with personalized service tailored to your private demands. They can take the time to understand your monetary circumstance and objectives, supplying tailored solutions that align with your particular requirements. Home loan brokers are proficient arbitrators that can aid you safeguard the most effective feasible terms on your lending.

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Tina Louise Then & Now!

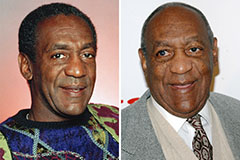

Tina Louise Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!